Chapter 12 Accounting for Partnerships Test Bank

Taxes payable by fiduciary. C The cash method can only be adopted by individual taxpayers.

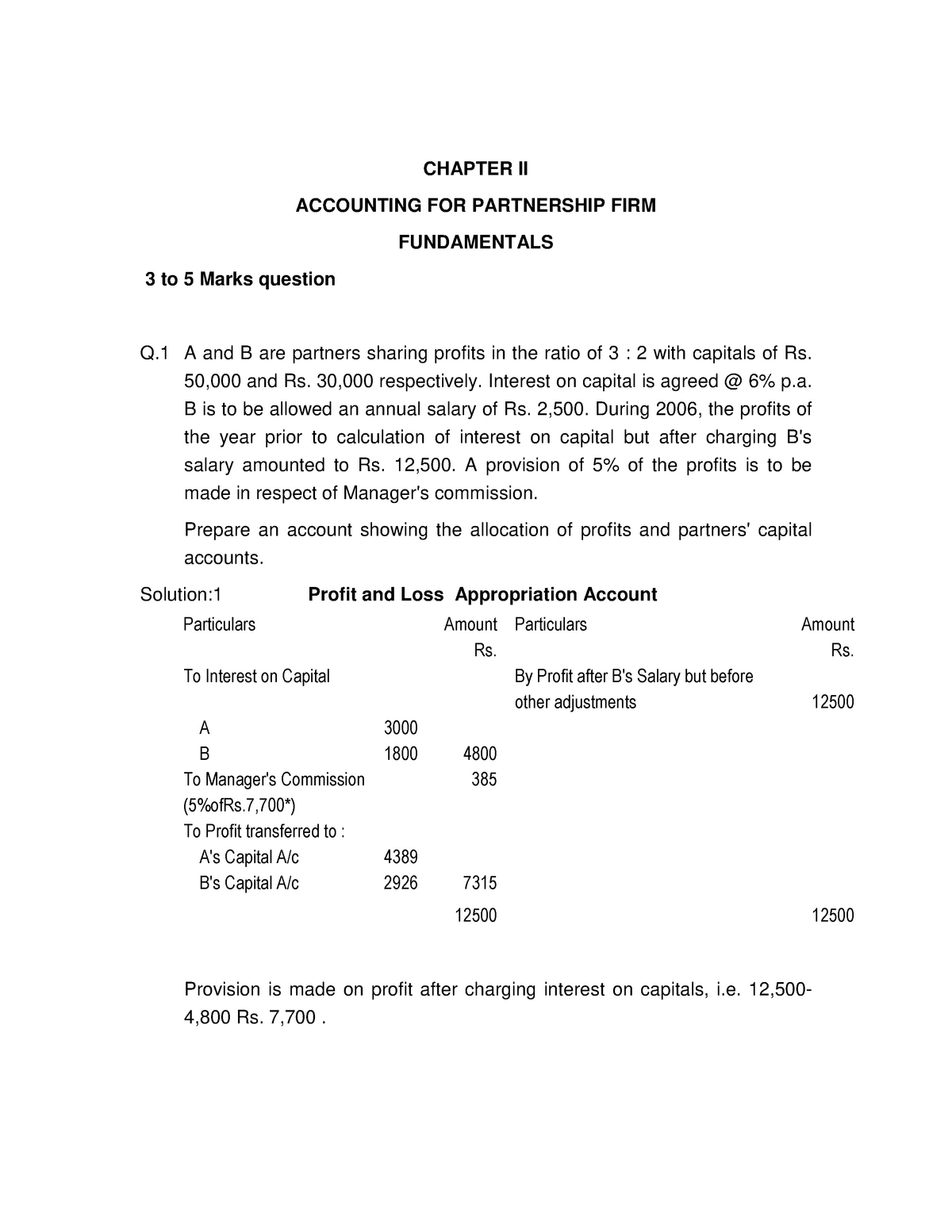

Partnership Accounting Sample Questions Chapter Ii Accounting For Partnership Firm Fundamentals 3 Studocu

Students can also access Commerce Class 11 and 12 Important Topics and study materials with chapter-wise Solutions on the Vedantu website.

. A In 2009 inDineors founders applied to TechStars which is a Boulder CO-based. Learn faster with spaced repetition. Your financial accounting treatment of inventories is determined with regard to the method of accounting you use in your applicable financial statement as defined in section 451b3 or if you do not have an applicable financial statement with regard to the method of accounting you use in your books and records that have been prepared in accordance with your accounting.

Trust funds received or held by trustees unless otherwise provided in the instrument creating the trust and funds received or held by guardians or conservators 1 may be invested in such real estate mortgages as the savings banks in this state may be authorized by law to. Financial Accounting has been evaluated and recommended for 3 semester hours and may be transferred to over 2000 colleges and universities. They were already in use in medieval times in Europe and in the Middle East.

4 Holding company means any company that controls or proposes to control a national bank or a Federal savings association whether or not the company is a bank holding company under section 2 of the Bank Holding Company Act 12 USC. Modifications of gross adjusted gross and taxable income calculated under Internal Revenue Code. Nature and Types of share Capital.

Accounting for share capital. Issue at par and at premium calls in. Free PDFs of Commerce Class 11 12 textbook solutions can easily be downloaded after students register on the website.

B An overall accounting method is initially adopted on the first return filed for the business. Persons subject to corporation business tax not taxable under this chapter. Partnerships have a long history.

Public subscription of shares over subscription and under subscription of shares. Which of the following is a true statement about accounting for business activities. For South Carolina income tax purposes gross income adjusted gross income and taxable income as calculated under the Internal Revenue Code are modified as provided in this article and subject to allocation and apportionment as provided in Article 17 of.

1841a1 or a savings and loan holding company under section 10 of the Home Owners Loan Act 12 USC. Issue and allotment of equity shares private placement of shares Employee Stock Option Plan ESOP. EVA - Virginias eProcurement Portal - eVA is Virginias online electronic procurement system.

Audit Evidence flashcards from Kia Raineys Florida International University class online or in Brainscapes iPhone or Android app. Study with Quizlet and memorize flashcards containing terms like inDinero the company profiled in the opening feature for Chapter 10 is described by its cofounders as the fastest way for small businesses to manage their finances Which of the following is not true about inDineros founding story. Exemption under section 12-702 not applicable to trusts or estates.

These study resources are created by subject matter experts. According to a 2006 article the first partnership was implemented in 1383 by Francesco di Marco Datini a merchant of Prato and FlorenceThe Covoni company 1336-40 and the Del Buono-Bencivenni company 1336-40 have also been referred to as. This web-based vendor registration and purchasing system allows state agencies colleges universities and many local governments to use eVA to conduct all purchasing and sourcing activities for goods and services.

A An overall accounting method can only be adopted with the permission of the commissioner. Determination of taxable year and method of accounting changes. Persons exempt from federal taxation exempt from taxation under this chapter.

It is also called as a partnership agreement. Download DK Goel Solutions for Class 12 Accountancy Accounting for share Capital. It is a record that outlines in detail the rights and functionalities of all parties to a business operation.

Course Summary Accounting 101.

Subject Accounting Grade 11 Chapter Partnerships Lesson Partnerships Concepts Lesson Overview Knowledge Areas Lesson 1 Kinds Of Partners Pdf Free Download

Mcq Questions Class 12 Accountancy Accounting For Partnership

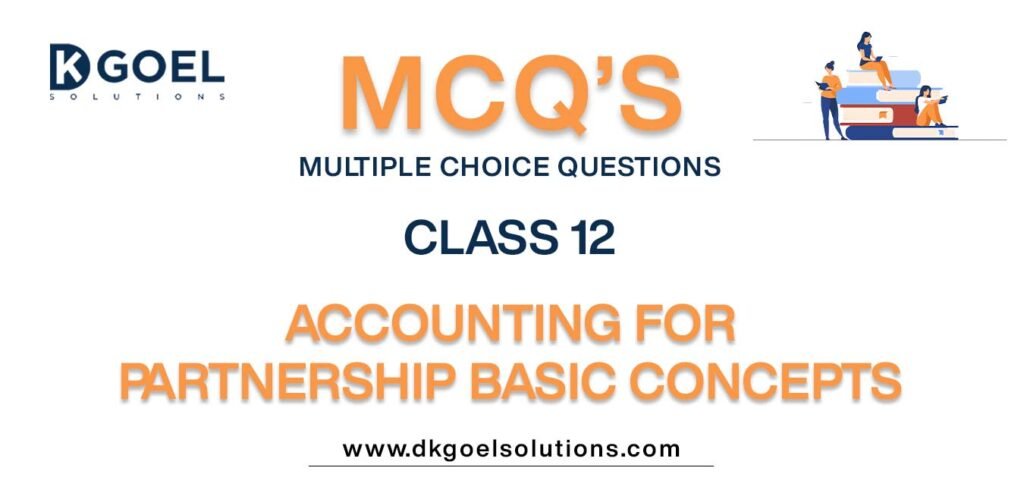

Mcq Test Bank Accounting Solutions 1 Financial Statements Are Prepared A Only For Publicly Studocu

Chapter 12 Accounting For Partnerships Principles Of Accounting Ii Instructor Bruce Fried Cpa Syllabus Questions On With The Course Ppt Download

Comments

Post a Comment